Exploring Credit Guarantee for Islamic Microfinance

UNDP IICPSD participated in the Frankfurt School of Business and Management Webinar on “Exploring Credit Guarantee for Islamic Microfinance”.

1st of August 2022- Frankfurt, Germany, the United Nations Development Programme Istanbul International Center for Private Sector in Development (IICPSD) participated in the Frankfurt School of Business and Management Webinar on “Exploring Credit Guarantee for Islamic Microfinance”.

Moderator Dr. Mohammad Kroessin, Head of Islamic microfinance at Islamic Worldwide Relief (IWR) and lecturer at Frankfurt school, opened the webinar with warm welcoming remarks, followed by a general overview of the Guarantee Scheme, followed by a panel composed of Islamic finance experts: Ms. Fatma Çınar, UNDP IICPSD Islamic Finance Portfolio Lead; Mr. Lotfi Zairi, Head of Sovereign Division at the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC); and Mr. Bernd Leidner, Chairman of the Management Board of Afghan Credit Guarantee Foundation. These representatives from Islamic finance organizations conducted a fruitful discussion and panel.

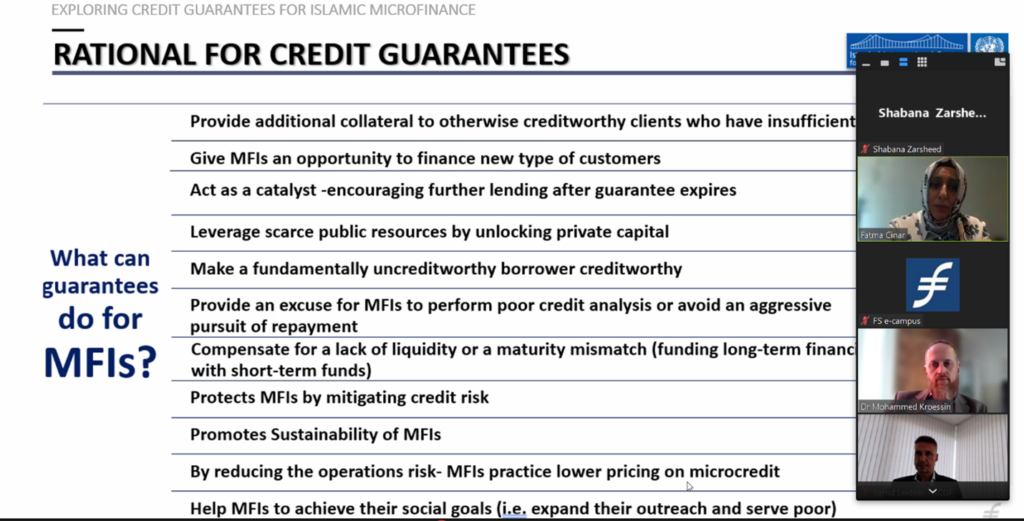

During the first session, Ms. Çınar discussed the rationale for credit guarantee funds in general and microfinance in particular, citing small business development, post-war economic recovery, youth employment, women’s entrepreneurship, mutual assistance, and better terms on loans for those who have already obtained credit as objectives of credit guarantee funds.[1]. Additionally, she stated that credit guarantee schemes are crucial to the sustainability of the microfinance sector as they allow them to offer microcredits at lower rates and reach a wider audience.[2].

A subsequent session addressed the experience of an Islamic credit guarantee fund by Mr. Leidner, who explained how the ACGF has successfully covered 44% of Afghanistan’s small and medium-sized loans during its 17 years of operation.

When discussing the difference between Islamic guarantees and conventional guarantees in terms of structure, Mr. Zairi stressed that “It is vital that we remember that Islamic financing only allows for interest-free loans such as Qard al-Hasan. Murabaha, Mudarabah, Musharakah, Wakalah, etc. are all Islamic Finance products that should not be confused with conventional loans.”

“Islamic credit guarantee schemes have become an integral part of Islamic finance institutions, and they are growing rapidly, also, issuers and investors are becoming more familiar with the mechanics of Kafalah as Islamic finance guarantee mode and Sukuk, making it easier to design guarantees,” said Ms. Çınar. As a means of facilitating this expansion and to assist countries interested in Islamic credit guarantee schemes but unable to establish them, she emphasised at the final discussion the importance of developing international partnerships among Islamic finance organizations to showcase Islamic Credit Guarantee schemes, as well as modeling from existing successful Islamic credit guarantee funds.

1. Muhamat, A.A., An investigation into SMEs’ perceptions of credit guarantee corporation (CGC) Malaysia berhad: A case study of Islamic guarantee scheme in Malays. 2008.

2. Leone, P. and P. Porretta, MICROCREDIT GUARANTEE FUNDS IN THE MEDITERRANEAN: A Comparative Analysis Palgrave Studies in Impact Finance series. 2014.